Workflow

-

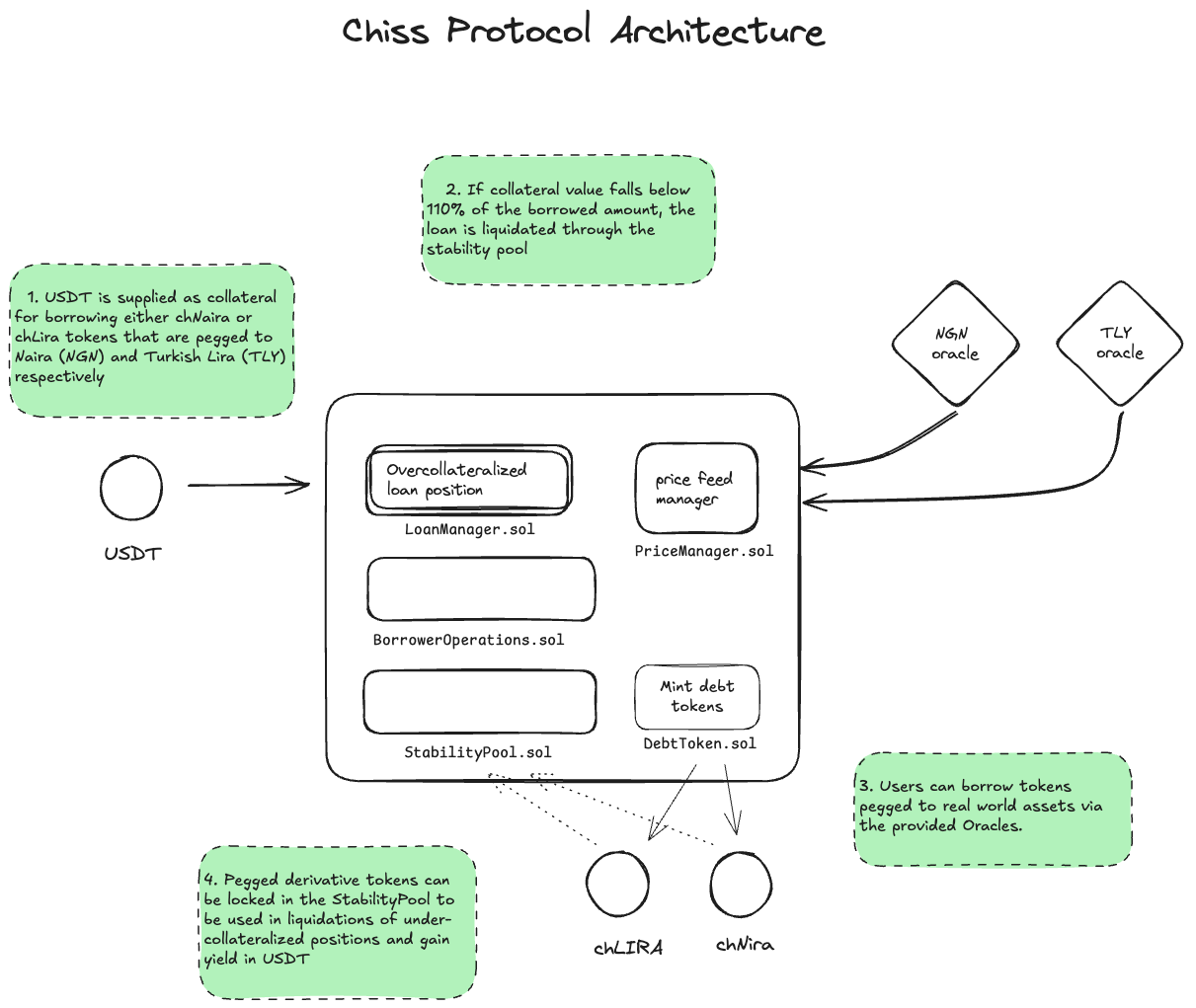

Collateralization and Loan Creation: Users begin by supplying USD-backed stablecoins (e.g., USDT) as collateral to the Loan Manager. The collateral is then used to mint localized stablecoins (e.g., chNaira or chLira). The Price Manager is used to determine the value of the collateral and the amount that can be borrowed.

-

Borrowing and Redemption: Once the loan is created, users can either use the borrowed stablecoins within the ecosystem or redeem them for fiat through Facilitators. Facilitators bridge the gap between the on-chain assets and real-world value, making it possible for users to directly access fiat.

-

Stability and Liquidation: The Stability Pool plays a critical role in maintaining the health of the protocol. If a user's collateral falls below the required ratio, the loan position is liquidated, and funds from the Stability Pool are used to cover the shortfall. The Stabilization Algorithm ensures that the liquidity of the system is maintained and the different pools remain balanced.

-

Flashloan and Cross-Pool Swaps: The Flashloan Mechanism allows users to perform cross-pool swaps. For example, a user may borrow chNaira and convert it to chLira within the same transaction. The stabilization algorithm automatically adjusts the liquidity to maintain the pool balances.

-

Repayment and Closure: Users can repay their loans at any time. Once the debt is repaid, the collateral is unlocked and returned to the user. The Borrower Operations component ensures a smooth interaction for loan repayment and closure.