🔍 Chiss Overview

A brief introduction to the Chiss Protocol FX Infrastructure.

Chiss Protocol is a next-generation FX infrastructure layer built to enable instant, global currency settlement for businesses and traders without requiring them to hold stablecoins or interact with blockchain systems. By embedding on-chain FX into a Web2-like experience, Chiss gives users all the benefits of blockchain liquidity, speed, and transparency while keeping the process entirely in familiar fiat currencies. This approach, called Onchain FX Abstraction, removes the need for wallets, tokens, or crypto-native UX, allowing businesses to send local currency in and receive foreign currency out instantly.

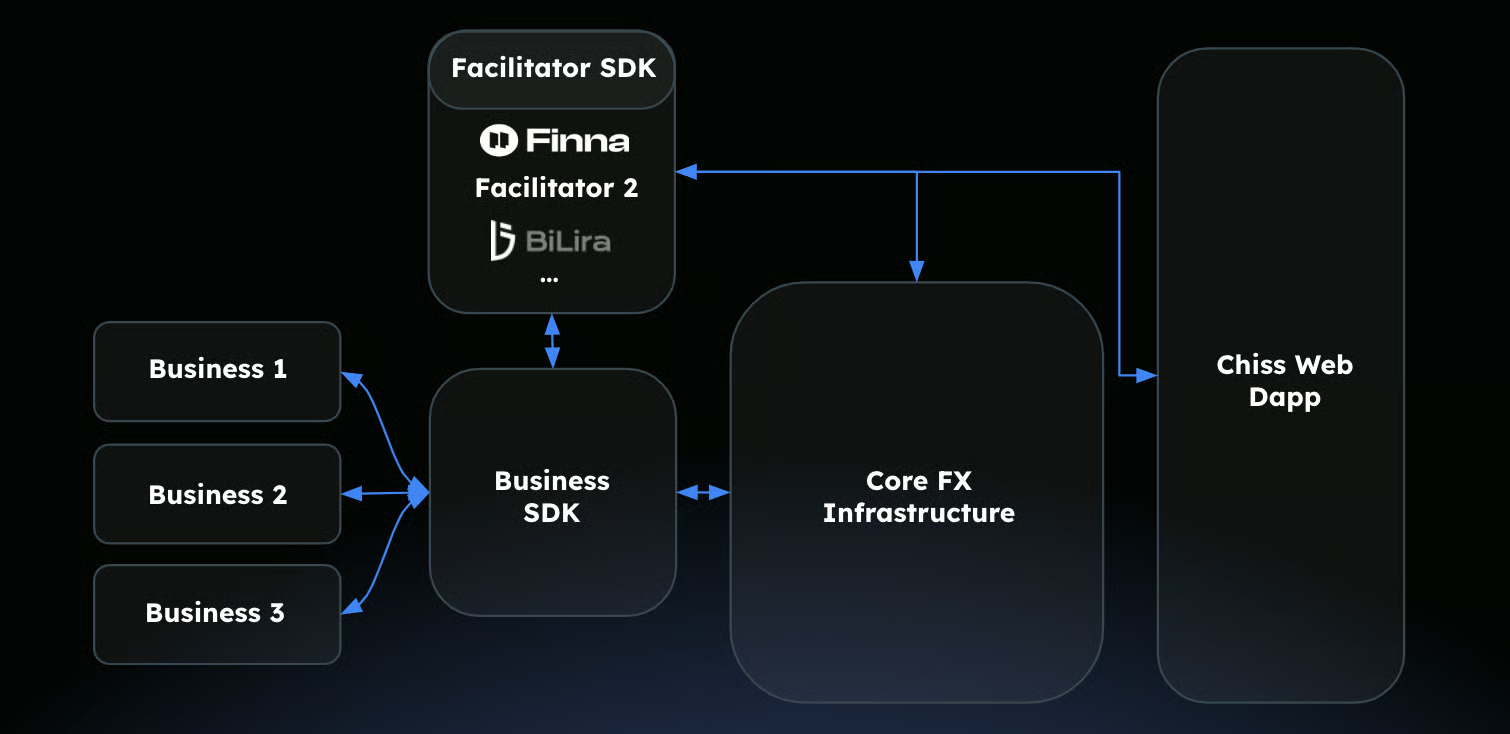

Under the hood, Chiss uses fiat-backed, protocol-native stablecoins issued 1:1 via a permissioned network of Facilitators, which are licensed fintechs and FX providers, that act as on/off-ramps into the protocol. This network integrates with minimal operational overhead, unlocking revenue and incentives for partners while providing seamless market access for end users. Chiss enables FX lending and swaps, enabling stablecoin holders to gain direct exposure to exotic currencies or execute cross-currency strategies without selling their core holdings. A hybrid AMM-oracle model delivers market-aligned FX pricing with reduced slippage and supports single-sided liquidity provision, minimizing LP risk and improving capital efficiency.

The result is a scalable infrastructure that bridges traditional finance and DeFi, opening the $7.5T+ FX market to both institutional and emerging market participants.

With Chiss, cross-border payments, portfolio hedging, and currency diversification become instant, accessible, and risk-managed—bringing the power of on-chain FX to the real economy, without the complexity of blockchain.