💱 FX AMM

The Cross Pool Market facilitates non-custodial, AMM-style FX swaps between protocol-native stablecoins. Users can directly convert currencies at oracle-informed prices within bounded slippage, with the protocol sourcing liquidity from the protocol’s aggregated FX liquidity pools. All conversions are settled onchain pool-to-peer, completely eliminating any counterparty risk.

The FX AMM powers the interface and serve as the transactional gateway for users to perform onchain FX operations on all interaction routes, Web dapp or Chiss-powered businesses via the SDK. Minimizing the participation of humans in the trade as in orderbooks, to enable algo-driven smart & seamless FX conversion, and settlement across multiple fiat zones.

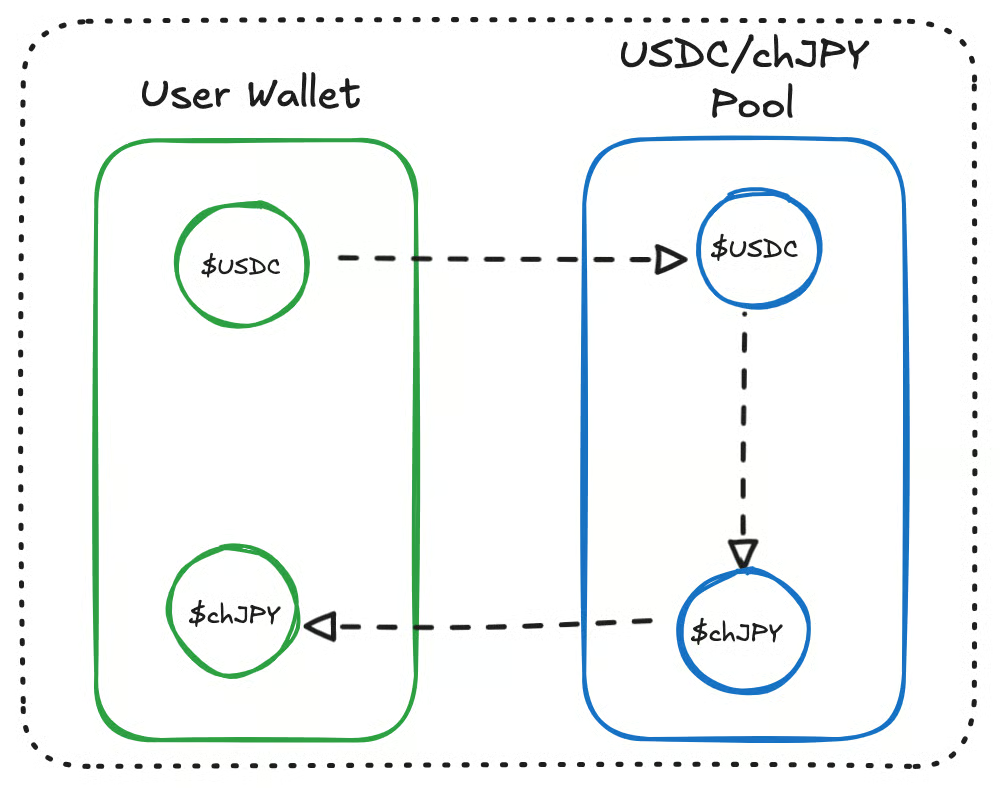

Single-Pair Swap

A single-pair Swap occurs when a user exchanges between two Stablecoins within the same liquidity pool, for Chiss protocol this usually takes the following form.

A single-pair Swap occurs when a user exchanges between two Stablecoins within the same liquidity pool, for Chiss protocol this usually takes the following form.

chNGN → USDC or USDT → chJPY

The swap is executed instantly using the StableSwap curve. No order books or counterparties required. The AMM serves as the counterparty, increasing trade efficiency. The exchange rate is pulled from the Oracle, ensuring alignment with the real FX market. This is ideal for quick conversions between two currencies with minimal slippage.

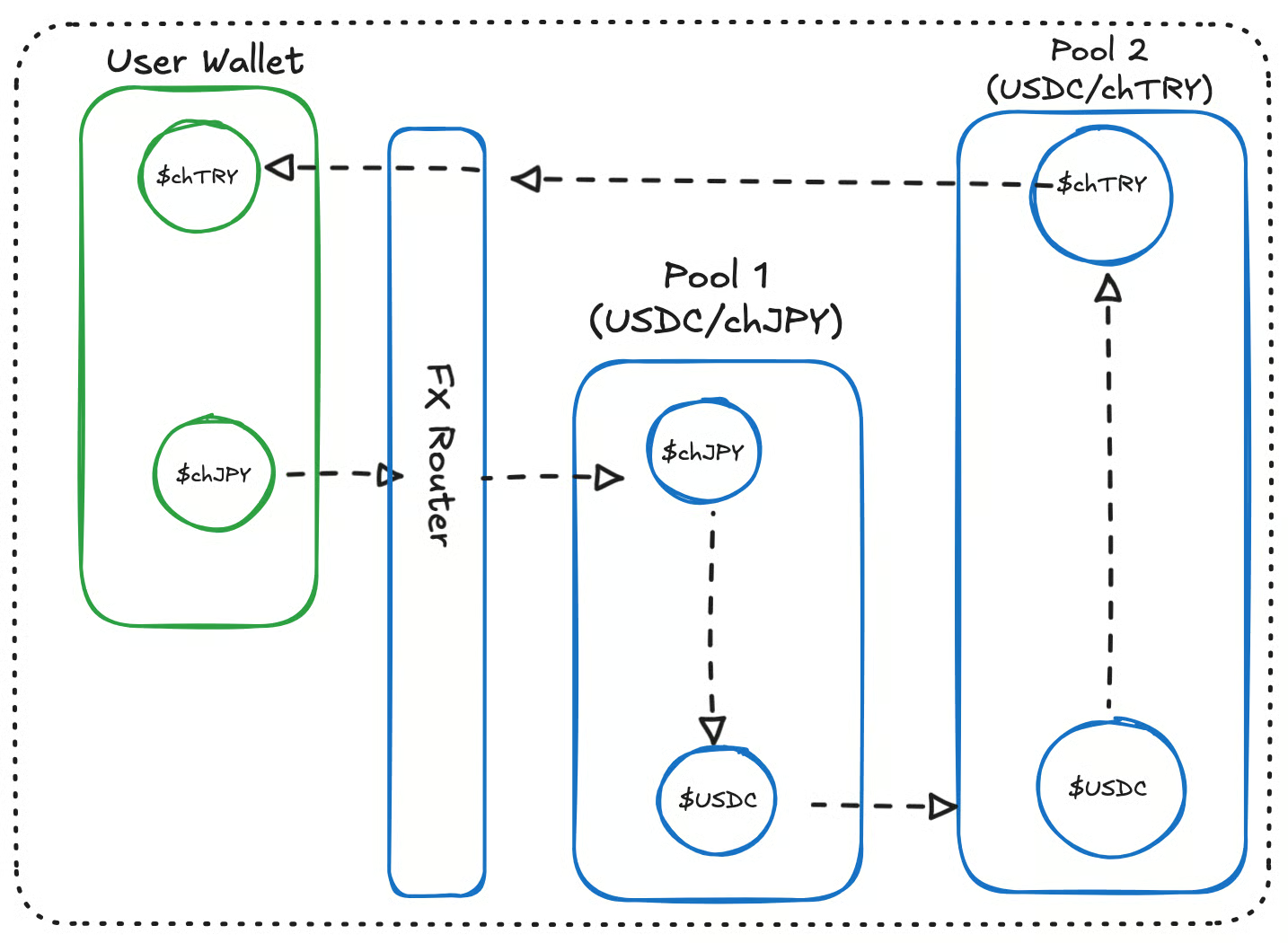

Cross or Multi-Hop Swap

A Cross-Swap is used when no direct pool exists between two currencies. The AMM automatically routes through a connecting currency e.g.:

A Cross-Swap is used when no direct pool exists between two currencies. The AMM automatically routes through a connecting currency e.g.:

chNGN → USDC → chTRY (to convert from Naira to Turkish Lira)

The Router contract chains multiple swaps into one transaction with the pricing and slippage are calculated holistically across all hops. Users still receive a final guaranteed output quote before confirming.

This enables access to any-to-any FX trading, even between rare or exotic corridors leveraging the deep liquidity of USD-pegged stablecoins with high efficiency.

AMM-Oracle Behavior

The AMM does not rely solely on liquidity pool balances to determine price, it also applies Oracle price feeds to attain the balance. Oracles feed real-world FX rates into the AMM. Swaps use these oracle prices to adjust the curve, preventing price manipulation. If pool balances drift too far from oracle prices, fees dynamically increase to incentivize rebalancing.

This creates a hybrid AMM that stays aligned with global FX markets, unlike traditional DeFi pools that can drift.

Keepers & Arbitrageurs

To keep the system efficient and fair Arbitrageurs monitor price discrepancies between Chiss pools and external markets via Chiss price oracles. If a pool is mispriced, they execute swaps that rebalance liquidity and earn profit.

This constant arbitrage activity stabilizes prices and improves execution quality for all users. With this mechanishms, Chiss does eliminates relying on manual intervention, the ecosystem is smart enough to self-correct through algorithms & incentives.