🔁 Last-mile FX Settlement

Business Onboarding & SDK Integration

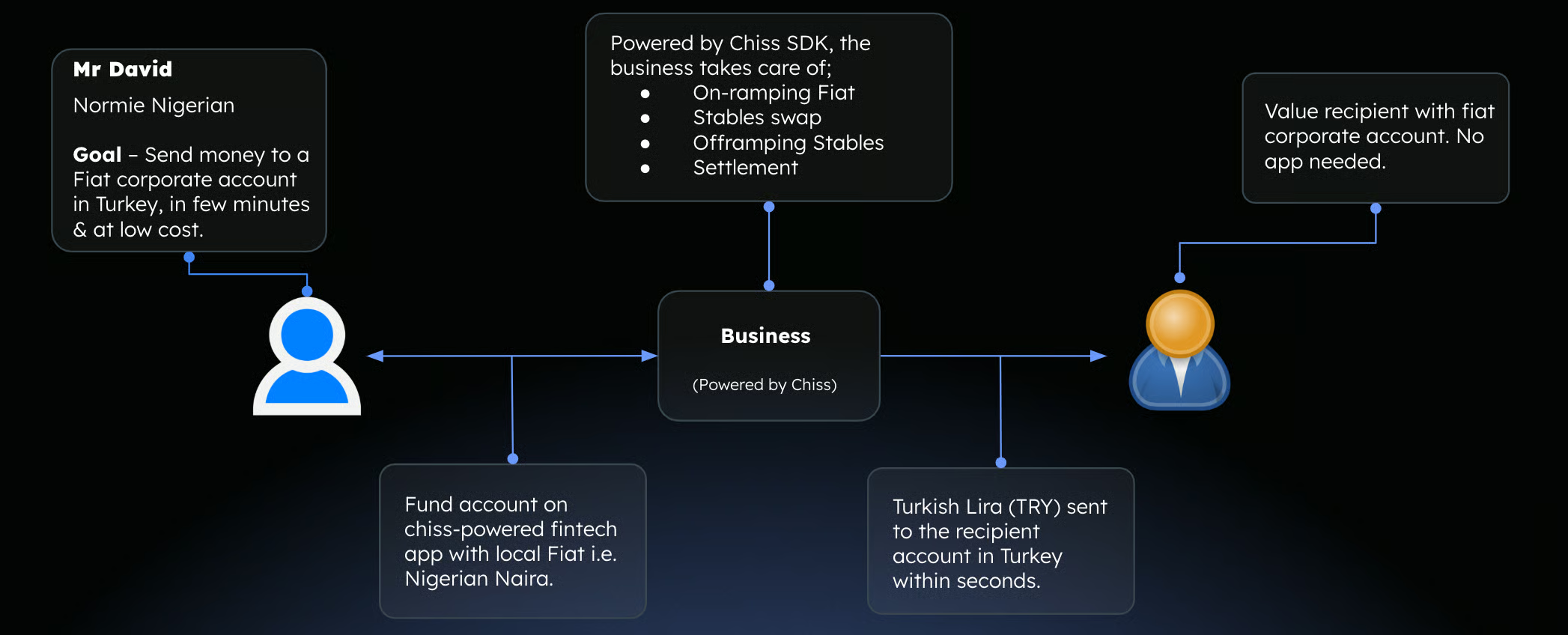

When a business integrates with Chiss, everything begins with trust and verification. Each new business completes a quick onboarding process that verifies its ownership and compliance information. Once approved, the business is granted access to Chiss’s unified FX infrastructure, ready to send or receive payments instantly across borders.

Powered by the Chiss SDK, the business can now interact directly with the FX system to:

- request exchange quotes,

- create and monitor transactions, and

- receive automatic status updates.

This ensures that, at any moment, the business knows exactly what stage each payment is in — from quote to final delivery.

Transaction Initiation

When a customer initiates a transfer, the process starts with a quote request. The business sends in the details;

- Source currency

- Destination currency

- The amount

- Beneficiary account

Within seconds, Chiss responds with a live rate. This rate already includes everything: conversion prices, applicable fees, and a full route showing how the funds will flow.

Behind the scenes, Chiss checks liquidity across multiple stablecoin pools to find the best possible price.

All this happens seamlessly and is displayed as a single rate to the business, no intermediaries, no hidden conversions.

Order Creation & Execution

Once the quote looks good, the business confirms the transaction and creates a payment request with the quote ID & beneficiary details. The order is created & validated by the Chiss network as it prepares fulfill the payment instructions. The business then deposits the local fiat currency (like NGN) through its existing facilitator or wallet balance. Once Chiss confirms that the fiat funds are in, the facilitator immediately moves into the core FX infra for the conversion phase.

This is where Chiss’s programmable FX infrastructure really comes alive. The deposited fiat corresponds to a protocol-native stablecoin, in this case, chNGN, which represents value held by the facilitator’s treasury. That chNGN is then swapped through Chiss’s FX liquidity pools for the target currency’s stablecoin, such as chTRY.

Throughout this process, the business never touches stablecoins or deals with blockchain interactions directly. Chiss handles all the minting, swapping, and routing under the hood through the business SDK. For the business, it’s just one smooth flow, deposit one currency, deliver another — settled instantly on-chain, visible in real time, and secured by cryptographic transparency.

Offramping & Settlement

Once the swap is complete, the converted amount is transferred to a facilitator in the destination region. That facilitator begins the final step, off-ramping the target stablecoin into local fiat & transferring it to the beneficiary account provided. Funds are then sent directly into the recipient’s bank account or digital wallet. The moment the bank confirms receipt, the transaction is marked as settled.

In just a few minutes, the cross-border transaction which formerly took T+3 settlement days is completed end-to-end from fiat in one country to fiat in another, through on-chain infrastructure, without any of the typical friction of legacy banking rails.

For businesses, Chiss turns international payments into a real-time experience. They can track every event , from “deposit received” to “funds delivered” directly within their system. No intermediaries, no waiting for banking hours, no uncertainty.

Every transaction on Chiss is transparent, automated, and final enabling businesses to scale globally with the confidence that their FX operations are handled with precision, speed, and trust.