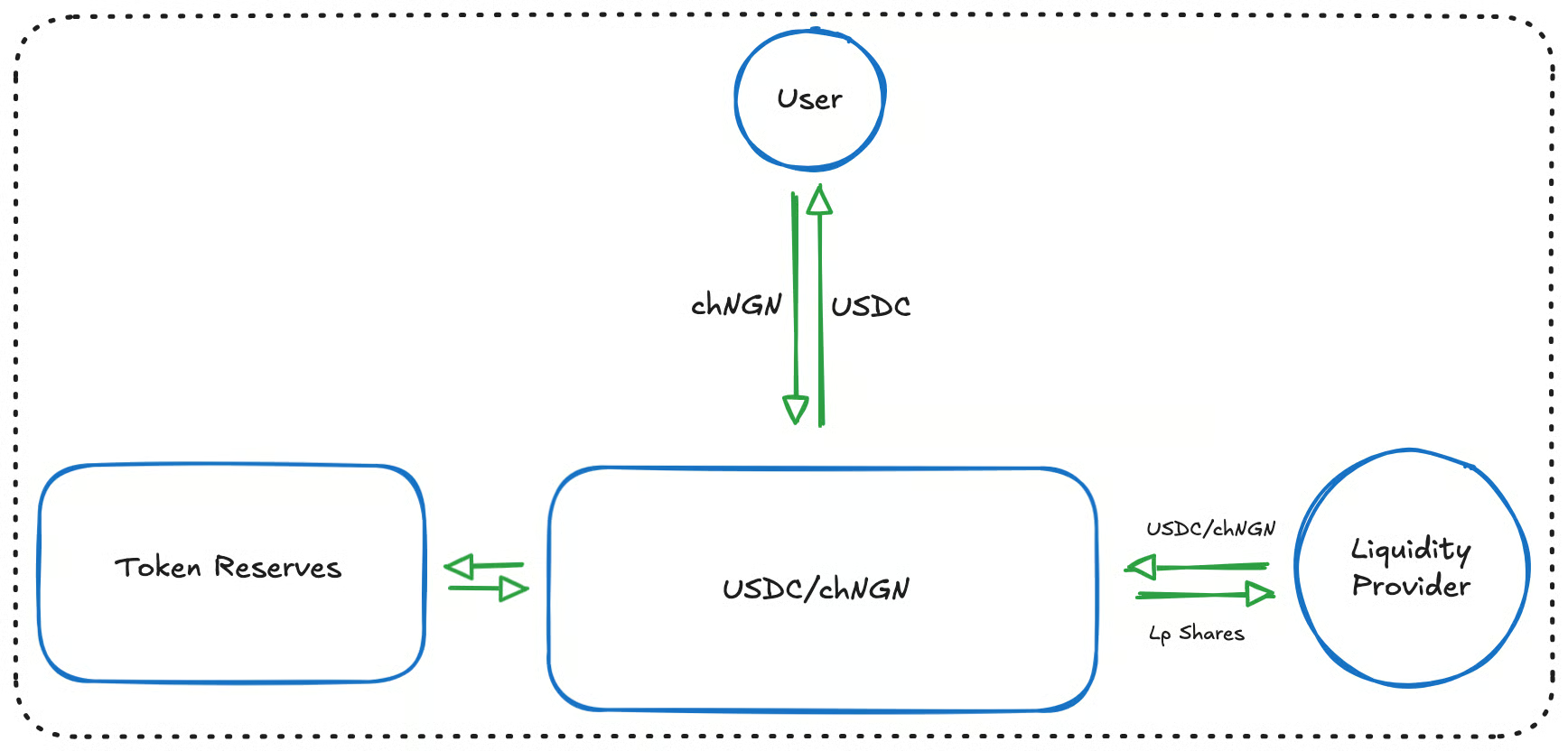

🩸 FX Liquidity Pool

Chiss replaces traditional fragmented FX intermediaries and counterparties with programmable, pooled capital, making FX liquidity globally accessible, always on, instantly settleable, and transparently priced.

An FX Liquidity Pool in Chiss is the core settlement layer where cross-currency conversions occur between protocol-native stablecoins e.g. chNGN ⇆ USDC/T, chTRY ⇆ chJPY.

Each pool is a single-pair type and powered by a hybrid AMM + Oracle pricing engine to ensure it stays aligned with real-world FX rates.

Functions of FX Liquidity Pools

-

Cross-Currency Swaps: Businesses and end-users can instantly exchange one local stablecoin for another without needing centralized brokers, correspondent banks, or intermediaries.

-

Smart FX Pricing: The AMM curve is continuously adjusted via trusted price feed oracles to reflect current FX market conditions leveraging arbitrage bots known as keepers. This reduces price gaps and keeping trades fair.

-

Yield Venue for Liquidity Providers: Facilitators, market makers, and passive stablecoin holders can deposit assets into FX pools and earn from every swap executed through that corridor (via spread or protocol fees).

Liquidity Provision

Each FX liquidity pool on Chiss Protocol is a single-pair currency pool i.e. chJPY/USDC, chNGN/USDC etcetera. However, the protocol allows single-side liquidity provision to reduce the risk of impermanent loss. For a chJPY/USDC pool, a liquidity provider can supply either chJPY, USDC or both in any proportion into the pool. Chiss Protocol has an internal pool balancing mechanism regardless of the type of liquidity supplied to the pool maintaining high flexibility for the provider.