💧 Stability Pool

The Stability Pool in Chiss Protocol is a lending liquidity layer. It functions as the primary lending liquidity source for FX-denominated borrowing and cross-currency exposure. Users draw from this capital reservoir when opening FX lending positions.

Liquidity Providers (LPs), precisely lenders, deposit protocol-native stablecoins (e.g., chUSD, chNGN, chTRY) into the Stability Pool. These deposits are made available as borrowable liquidity for users engaging in FX lending. Borrowers pay interest, which is dynamically adjusted based on utilization and currency risk. Interest is automatically streamed back to LPs, making the Stability Pool a yield-bearing passive strategy, effectively allowing users to earn FX yield without active trading.

The Stability Pool democratizes access to the FX market, historically reserved for hedge funds and institutional treasuries. Any participant, whether a user or an integrated business or facilitator, can:

- Earn FX-denominated interest by supplying liquidity

- Enable borrowing for real-world cross-border activity

- Contribute to efficient capital flow between currencies

Liquidity Provision

The Stability Pool in Chiss is a single-currency lending pool, designed to fund FX borrowing activity while offering predictable, currency-denominated returns to liquidity providers (LPs). Unlike the FX Pool, which has dual-sided liquidity for swapping between two currencies, the Stability Pool accepts only one asset per pool, making participation simpler and risk exposure more controlled.

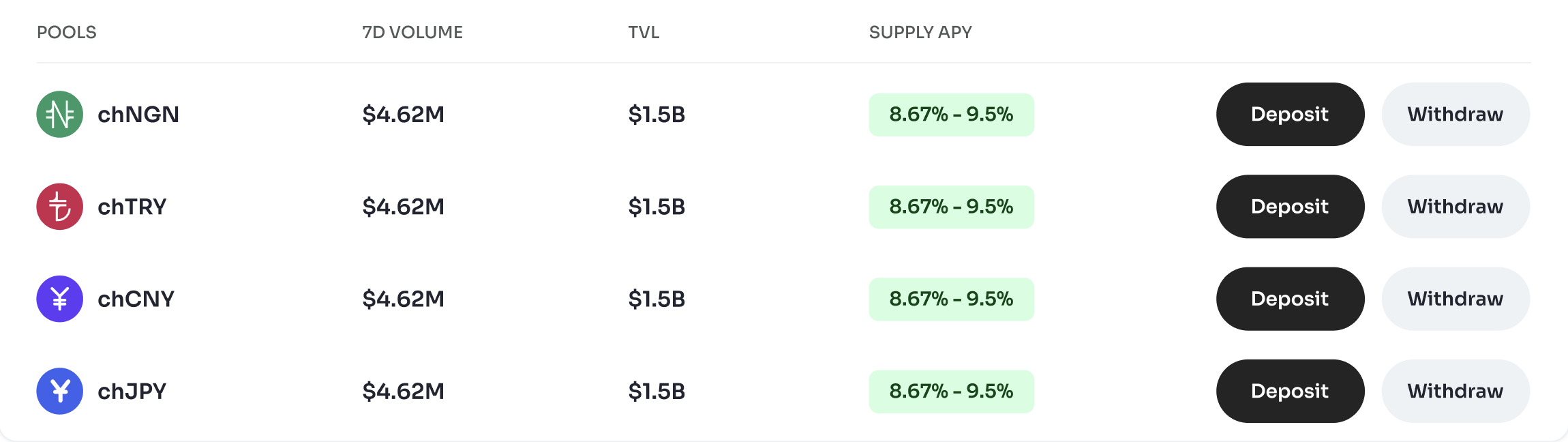

To provide liquidity, select the specific Stability Pool they want to provide liquidity to, for example, chNGN Pool, chTRY Pool, or chJPY Pool as shown below.

LPs can withdraw their funds at will unless a large percentage of the pool is currently borrowed. In such cases, a withdrawal queue or partial exit system ensures orderly liquidity flow without disrupting borrowers.